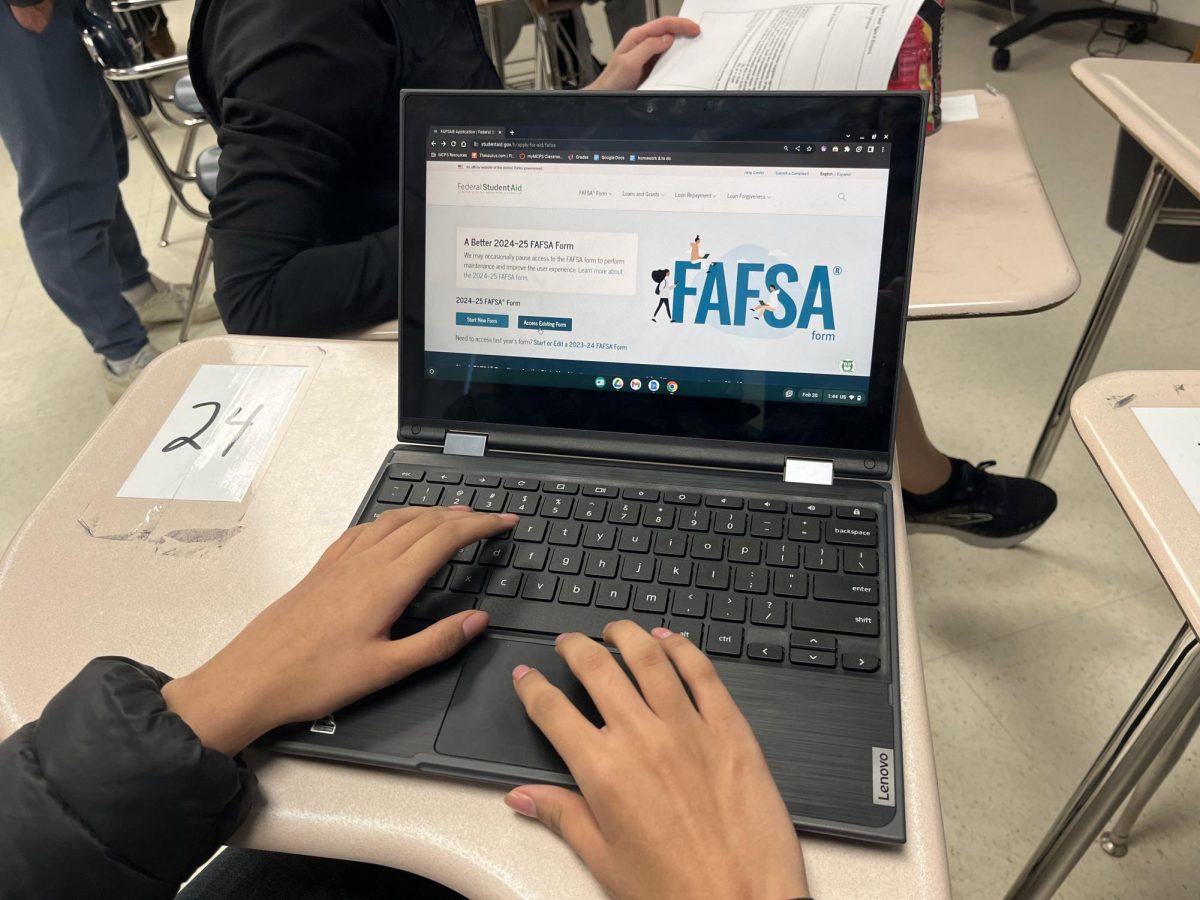

Every year, around 18 million students complete the Free Application for Federal Student Aid (FAFSA). Created to provide federal aid to students who demonstrate financial need, the FAFSA has long been relied on by students across the country. This year, however, the FAFSA has been less than convenient—suffering from glitches to long-term delays—leaving WCHS students stressed and confused.

Not only was the 2024-25 FAFSA delayed, opening on Dec. 30, 2024, as opposed to the usual Oct. 1, but it has been riddled with technical issues. There are 19 known technical errors, preventing some students and families from completing the form. These difficulties have resulted in only four million students submitting the 2024-25 FAFSA form so far, a record low compared to past years.

“Aside from the FAFSA coming out months late, I have been dealing with glitches and the website shutting down,” WCHS senior Alvia Naqvi said. “When I first started filling out the form, the website crashed and I had to rewrite all my information, which was frustrating.”

Each year, the Federal Student Aid distributes about $112 billion worth of grants and loans to assist students in financing their college education. As many students rely on this aid to get them through college, the issues with the FAFSA have been more than simply upsetting.

“The FAFSA empowers so many low income students to attend college, and these issues are taking opportunities away from students like myself,” a WCHS senior who wishes to remain anonymous for financial privacy said. “It has gotten to the point where I’ve had to miss school to complete the form because it was only functioning during certain hours. The process has been exhausting and this is something that never should have happened.”

With the delayed release of the FAFSA comes consequential delays in the creation of student aid packages. Now, colleges will not receive student data until March, forcing students to wait longer for financial aid awards and providing them less time to decide on their college choice.

“I’m frustrated and upset. I have to commit by May and I’m not even remotely going to know what my options are until April at the earliest,” the student said. “My parents work multiple jobs yet my annual household income is unable to support my college fund; I have to rely on this financial aid.”

In response to the FAFSA crisis, many universities are considering extending their deadlines. Most colleges ask students to commit by May 1, but may push back the deadline to accommodate these prolonging issues. The University System of Maryland has opted to extend the deadline for undergraduate students to make their decisions, moving it from May 1 to May 15.

“Giving students more time to commit is a step in the right direction,” the student said. “This isn’t the fault of the universities; this is the fault of the Federal Student Aid, but I think it’s great if universities want to help mend the blow of it.”

Besides the delays, concerns surrounding the amount of aid students will receive have arisen. This year’s FAFSA aimed for simplicity by implementing a new calculation known as the “Student Aid Index,” which determines an estimate of a family’s affordability. This new index means that federal grants will be more accessible to low and moderate income students. However, the change has implied reduced eligibility for wealthier families.

“I think that for a lot of people, the aid before all these issues wasn’t even enough,” the student said. “And now the fact that it’s going to be even lower makes me worry for my future. I deserve an education just as much as anyone else and I firmly believe that someone’s financial circumstances should not affect if they’re able to attend college.”

Amid the chaos, Secretary of Education Miguel Cardona has said that the U.S. Department of Education is working to alleviate the challenges faced by schools and students. This involves establishing a helpline and sending experts to financial aid offices at college campuses to provide support.

“I think there’s room for improvement with how the situation is being handled,” Naqvi said. “I understand people are working behind the scenes to get this issue resolved, but I just wish we had more information. It’s tough to sit back and wait while your future is in someone else’s hands.”

As these unprecedented challenges are being addressed, many students remain uneasy about their future. The FAFSA plays a crucial role in enabling millions of students to pursue higher education, intensifying the concern that its issues could negatively impact their college plans.

“As a student, I’m very proud of my accomplishments. But now all of that could go to waste,” the student said. “I was admitted to the University of Michigan, Georgetown and the University of Virginia—some of my top choices, but there’s still one thing in the way of me going: the price tag.”