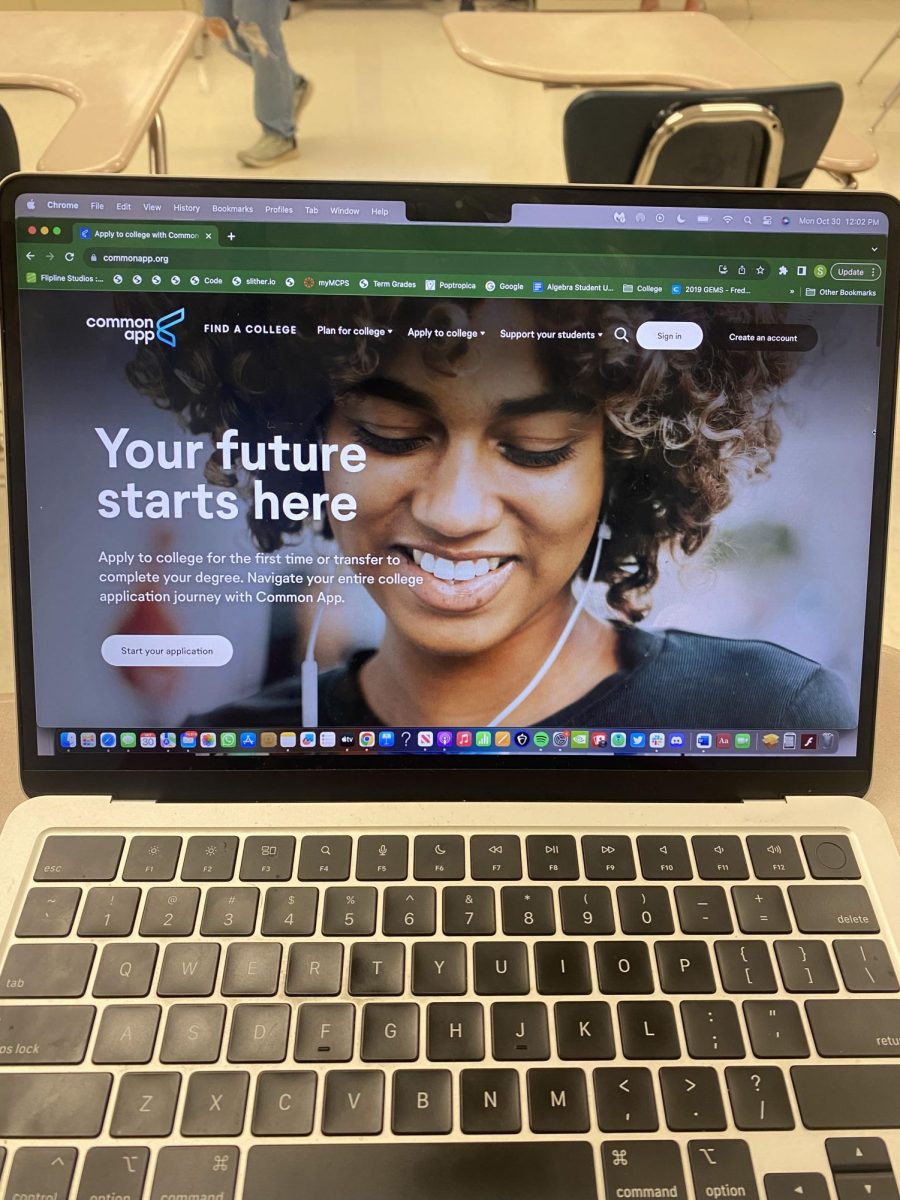

As the college admissions process comes to a close, CHS seniors have begun to finalize their college plans. Now more than ever, students are forced to look at all angles of the college experience, especially cost. With student loan interest rates increasing and the economy remaining stagnant, students must consider a looming burden after they graduate from college: debt.

Last year, Congress passed legislation lowering interest rates on student loans to 3.6 percent, but only for those students who took out loans after July 1, 2013. However, students who took out loans before July are grandfathered into the old interest rate of 6.8 percent.

“Students need to take financials into account,” CHS alumna Brenna Means said. “This day and age, grad school is almost a sure thing like undergrad is. If you have to take out loans for both undergrad and grad, you are going to be suffering from loans for the better part of your post-college career.”

According to a Feb. 24 Huffington Post article, people tend to be better at managing their credit cards, mortgages, auto loans and equity loans than managing their student loans.

Although interest rates have been lowered to 3.6 percent, students still feel the impacts of these loans, having to discuss where to allocate their money for the future.

According to a December 2013 study by the Institute for College Access and Success, 70 percent of the national Class of 2012 graduated with student loans, and the average amount of debt among students who owed was $29,400.

Some CHS students making their college decisions based on their financial situation, and committing to an in-state school, for example, it gives students more financial leeway.

“My decision was financially based,” Means said. “I opted for the University of Maryland because the education I could receive at all of the other universities I was accepted to was of the same caliber.”

For other students, their financial situation is not their top priority when choosing a college, but they do not disregard tuition completely.

“Depending on their financial situation it will effect what schools they can apply to, but even if there is no financial problem I think students should be involved and aware of the financial aspect because they will need to know how to deal with it later in life when they are on their own,” senior Claudia Barnett said. “I am not that worried about my financial situation when I get out of college, but I plan on supporting myself as fast as I can, so getting a job would be my financial worry after college.”

Katherine Liola, Certified Financial Planner and President of Concentric Private Wealth in McLean, VA, recommends parents have an open conversation with their child about what they can and cannot provide. In addition, parents need to keep in mind that education can be financed but retirement cannot.

Liola also recommends that students gain “real world” experience by earning income for at least two summers while in high school.

“For students who do have school loans, the greatest challenge, I see is finding the right balance of paying down the loans, while still paying other bills, enjoying their 20s and still saving for a rainy day and their long term future,” Liola said. “In addition, there can be a great deal of confusion around payment terms as well as an emotional battle with accepting the level of debt as part of their life for the term of the loan.”